The newest stock surged from the current diversity highest during the $22.97 and you may https://www.oodlesmarketing.com/fx-and-you-can-currencies-trade-a-newbies-publication/ cleaned mental resistance from the $23. Unlock the brand new amazing property value gold with your personal 2025 Gold Anticipating Declaration. Mention why silver remains the best money to possess shielding riches up against inflation, financial shifts, and you will worldwide uncertainties.

A popular approach community over, breakout move approach relies heavily for the which have a good technology research feel. Investors fool around with trendlines, service and you may opposition membership, and chart designs such as triangles and you can flags to identify possible outbreaks. It’s a speculative strategy for change securities where people hold a protection for many months otherwise days to benefit out of brief-label speed changes otherwise swings. Yet not, as his or her ranking are nevertheless unlock for days otherwise days, he’s confronted with some risks as well. ST are a primary- or typical-name trading method you to definitely buyers use to benefit away from speed swings away from securities.

However, it buy the inventory in the event the down pattern reveals signs of exhaustion and resell they after the brand new rebound. Trade sells extreme risks, like the potential death of the very first investment or higher. Most people generate losses, and you will change is not a guaranteed way to wealth. Items like Fx and CFDs try state-of-the-art and you can encompass leverage, which can magnify growth and you can losings. CFD change is prohibited in lots of nations, for instance the United states.

Within a swing buyer’s method, they will slim greatly for the technical research to build rely on inside a trading position. The brand new technology investigation spins up to historical rate habits and newest rates step to determine appropriate admission and exit points. By investigating an excellent stock’s rate record, including, you could pick style and rehearse one suggestions to find the better time for you to go into the right position. Regardless if you are playing with chart habits or simple assistance and resistance profile, you will need to be alert to the newest pattern across multiple date frames. For example, when you are handling a chart to the daily day physique plus the trend is actually bullish to your 4-time, daily, and you may per week maps, the fresh bullish signals that you identify tend to be more extreme. Details that you result from a chart that will be aligned which have the new wide development around the additional go out frames will result in effective positions.

Knowledge Move Change – Just how Move Investments Functions

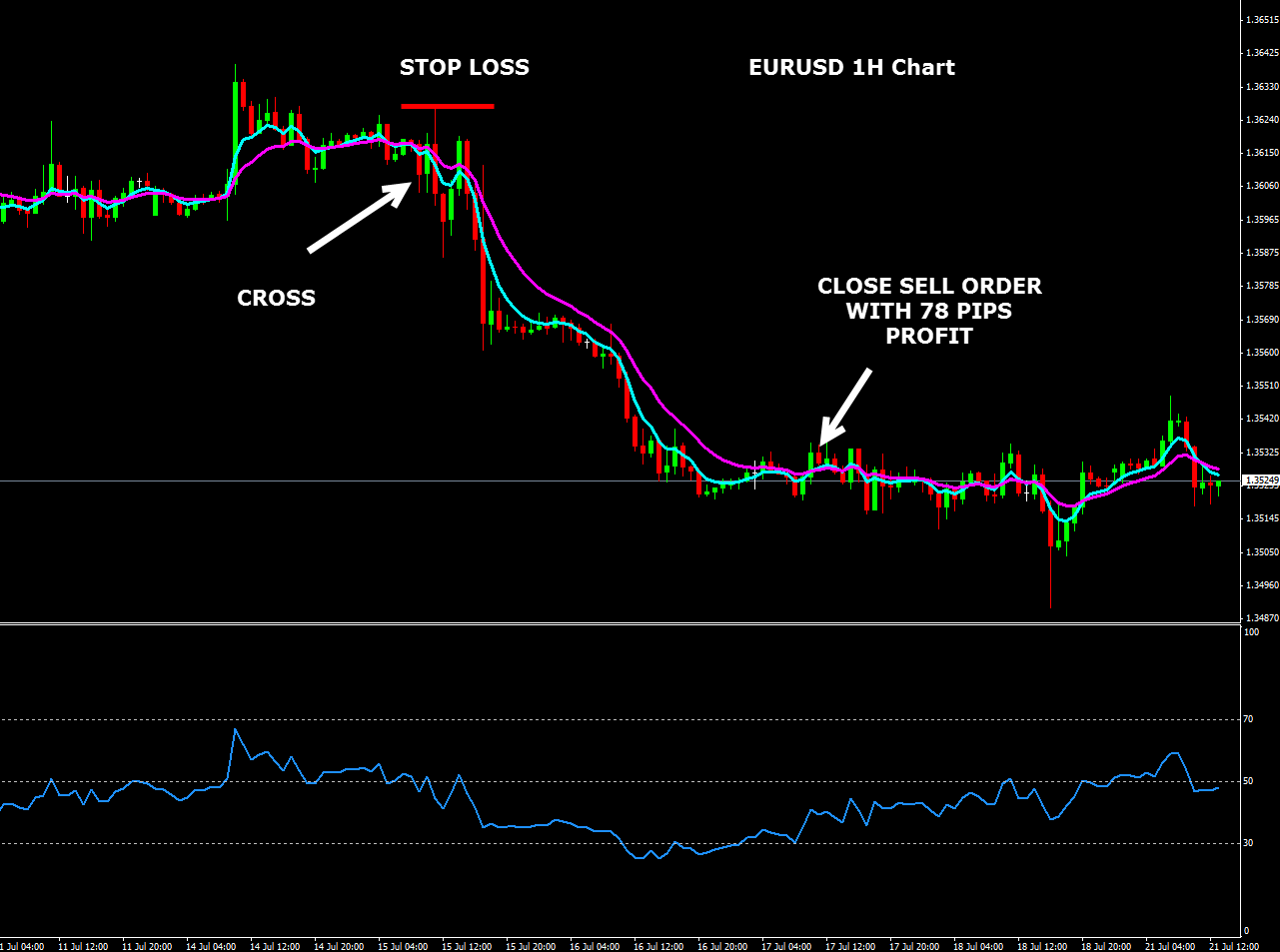

Swinging mediocre crossover things try helpful to several swing trade actions. Generally speaking, traders you will ending you to definitely cracking because of a moving mediocre is a good signal of a new pattern performing. Technical symptoms of help and you will opposition account are vital. But what is very hard is actually searching for precise indications throughout the years. Such as, synchronous account are simply just the greatest and you may reduced replaced thinking in this a particular timeframe.

Another go-to help you indication ‘s the cousin power list, and that tries to size whether a protection is actually oversold otherwise overbought by the researching their current rates motions. In the event the a safety are overbought, it may in the future be heading for a development reverse and get rid of really worth, however if oversold, it may be returning to swinging high. This tactic involves distinguishing stocks that have experienced an effective development and could be ready to contrary guidance. Investors discover signs of weakness in today’s development and you may enter investments expecting a jump. The fresh reversal approach will make the most of rate reversals when a inventory or advantage change advice once a pattern. Reversal steps try riskier since the reversals are very difficult to anticipate.

How come Move Trade Works?

Thus, swing people have the ability to secure the same sum of money while the scalpers if you are doing points that are reliable and wanted additional time. In the same vein, buyers whom participate in scalping is actually shielded from the newest ample losings that will be related to just one bargain. While the move change ranks may be established in only a short while otherwise around 2-3 weeks, move investor need not continuously observe the holdings frequently. Of course, a great swing investor would utilize defensive prevent-loss purchases (automatic sell requests if the an amount drops past an acceptable limit) on the one to method. Swing change works by taking advantage of the new short-label shifts in the industry.

Because the positions are held for several days or weeks rather than minutes otherwise days, swing buyers aren’t compelled to create split-next conclusion under some pressure. Of a lot winning move traders report investing just 1-2 hours each day to your field study and you may trading administration, making it a practical choice for operating advantages. In the event the tech research is completed correct, an excellent production can be had regarding the short or average identity. At the same time, it has an edge more than date change too – move exchange does not need constant keeping track of. Enough time saved can be used to deal with other funding actions.

Walmart says highest costs you may struck so it month because of tariffs

This site are neither an excellent solicitation nor an offer to shop for/Offer futures otherwise possibilities. No symbolization is being generated you to definitely any membership tend to or is attending go profits otherwise losses like those people chatted about to the this web site. The past efficiency of any trade program or strategy is not fundamentally an indicator from future overall performance. Product investor Richard Dennis educated the fresh turtle means in the eighties. The concept is to find outbreaks and you will log off the positioning whenever cost begin to combine from the a high part or beginning to refuse.

The brand new pullback means brings together pattern pursuing the and suggest reversion, targeting short-term retracements within this more significant style. Some great benefits of having fun with move exchange tips tend to be increasing short-label funds prospective, and you can minimal date union. A-swing investor manage identify a possible development and hold the new change(s) for several days otherwise days. A breakout technique is a strategy in which a trader requires the right position for the early area of the uptrend, searching for a market otherwise inventory that is most likely so you can ‘bust out’. The newest buyer goes into the brand new change once they discover the desired quantity of volatility and course away from an inventory you to vacations an important factor of stock’s assistance or opposition. People play with of many technical indicators to spot change options.

🤔 Expertise move change

Instead of time people, who tend to build of several deals and you will close out all of the positions at the the termination of everyday, move buyers come across larger actions and you can hold the positions to possess lengthened episodes. Time trading try a short-name spending style, when you are condition trading are a long-label design. Having said that, move investors aren’t gravitate to the carries, indicator, merchandise, and replace-replaced money (ETFs), thanks to its exchangeability and you can foreseeable models. This tactic is best suited inside popular locations, particularly when reports otherwise wider belief supplies the disperse an effective force. Move traders using impetus setups often blend tech habits (such as flags otherwise combination breakouts) that have verification out of volume otherwise cousin power. Swing change and date trade is similar, if you are a lot of time-identity using is something more totally.

He’s widely used because the indications of when an instrument features getting overbought otherwise oversold. Preferred oscillators were stochastics, the new relative power index (RSI), and you can swinging mediocre overlap divergence (MACD). If the stochastic outlines move over the 80 peak, it means your industry can be overbought. In contrast, if the stochastic outlines cross beneath the 20 level, it means that the market industry is generally oversold. While you are swing change offers exciting opportunities, it’s important to watch out for problems, including volatility, ideas, and too little means.